E-platform for marketing seafood

July 16, 2015

By Erich Luening

The seafood industry is a major commodity market that still uses outdated and inefficient processes to buy and sell product. Ocean Executive provides a method to modernize the sector’s trading system

The seafood industry is a major commodity market that still uses outdated and inefficient processes to buy and sell product. Ocean Executive provides a method to modernize the sector’s trading systemE-commerce over the span of the internet age has worked in some industries while not so well in others but in the agricultural sector online marketplaces have found success in selling everything from farming equipment to new born chicks and now a Nova Scotia-based company wants to do the same for seafood producers, including fish and shellfish farmers.

The folks at Ocean Executive (oceanexecutive.com) have set up essentially a business-to-business (B2B) marketplace that offers an open bilateral bid/offer exchange and private auction e-commerce platform for seafood companies throughout the supply chain; from the fishermen, fish farmers and processors who pull the product from the water and package it, to the wholesalers, distributors, traders, brokers and food service combines that deliver the finished goods to grocery stores, retailers, and large restaurant chains.

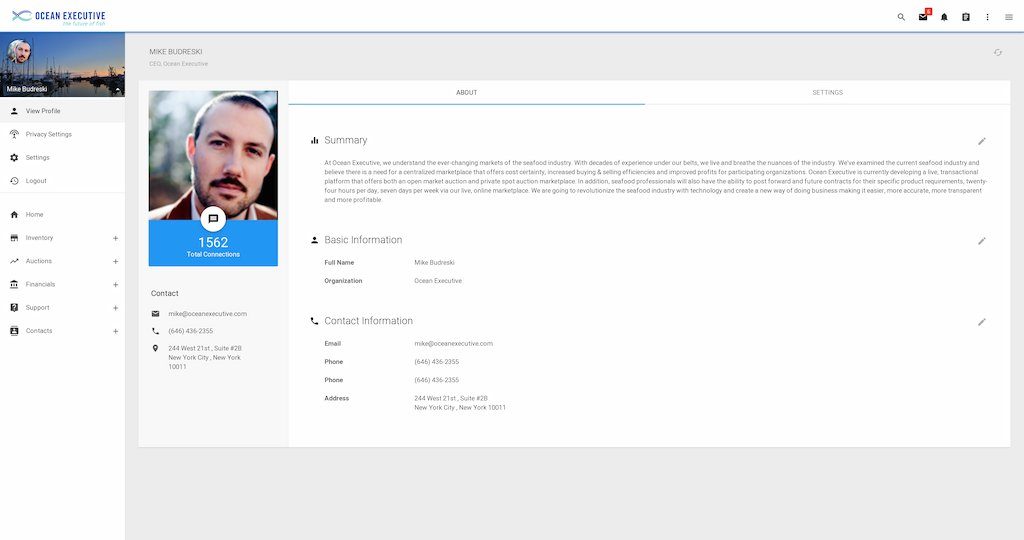

Founder Mike Budreski is from Nova Scotia but followed his wife six years ago to New York City, where she went to school and wanted to build a career. He grew up on his father’s shellfish and sea urchin farm and ended up on the trading floor at the New York Stock Exchange (NYSE) in the gas and oil sector.

“It’s taken me down to the stock exchange,” Budreski told FishBytes on a phone call standing outside the stock exchange building in lower Manhattan on a June morning. “I basically got the idea from oil and gas and coffee industries. They do a lot of work with online trading commodities versus trading in the pit. I took that application and technology and applied it to the seafood sector.”

Currently he said there is no spot-market for seafood and futures. There was a need for a centralized marketplace online, he explained.

The Nova Scotia-based company is putting the final touches on their online trading platform which they hope will improve supply-chain efficiency for seafood professionals. A CAD $100,000 seed investment from early stage venture capital firm Innovacorp will finish the product development and explore markets.

“Currently we have a beta site where you can create your profile with your products listed,” Budreski said. “Soon you’ll be able to auction your product to registered buyers. This is an industry so resistant to technology that we have tried to make it as easy as possible to navigate and get set up to trade.”

First trades could happen within the year.

How it works

For the most part the online experience for wild fishermen and aquaculturists trading their product on the exchange is the same with a slight edge for seafood farmers.

“I would say it’s the same for each user, but aquaculture can benefit from what we’re doing in the next year or so,” Budreski explained. “Farmers know what they are going to produce in the future and can price that way. That’s a good feature for the farmer. They know the product they will have in hand where fishermen don’t. Aquaculturists will be able to pre-sell their products.”

The Ocean Executive platform provides beta users with a price discovery tool and full data analytics on price, volume, and trade location for every species traded within the marketplace. Future additions to the platform will allow seafood professionals the ability to post forward and future contracts for their specific product requirements, 24 hours per day, seven days a week via the live online marketplace, according to Budreski.

The platform is designed as a conventional auction-based model, merging the technological aspects of the online exchange with standard practices of fishermen, fish farmers, processors and commercial purchase agents. “You can join for free and post what you want,” he said. “We take a small commission on the public market place sales. For private marketplaces we take a flat fee of $250 dollars. Open marketplaces will have growers and buyers in Asia, Europe, and North America.

“There are two different marketplaces,” Budreski explained. “The private one and the open or public marketplace. The private marketplace is where you invite your existing customers and you can hold an auction just for your invited buyers. Say you put it out to ten buyers and eight apply for the auction, they can’t see one another, all they can see is the volume and the price.”

You can split the sale up and award it between the buyers without having to do any of the leg work, he said. You can piecemeal the sell to three different buyers by a click of button. Wholesalers can invite producers to a sell auction by sending out buying orders for a reverse auction as well.

“Open marketplace is the same sort of thing. But with no ability to split up,” he said. “You just say here is my offer of volume and sell as a whole. You will see the bids going and coming in. The tool will list the volume, bids and brand.”

When asked how Ocean Executive will ensure the products being sold are of high quality and sustainably produced, he said trust will be built through the relationships developed online and through familiarity of the brands of products being sold.

“That’s the thing. With the private marketplace you will already know the clients and producers,” explained Budreski. “If there are any quality issues, they will sort that out. We are just the vehicle for selling your product. In the public marketplace, brand is huge. If you are buying a brand you’ve never used – do a test and buy a smaller amount of product. If there is a huge issue, we would get involved”. Producers will also be given a checklist of global sustainability certifications to show buyers.

All users connect directly, in real-time, using the open or private auction marketplace. Users will be able to customize the tools for trading, optimizing logistics by choosing trading hubs and delivery points on the platform. The platform will also help manage distribution channels and supply as well as integrate with aquaculture business inventory systems for better planning.

The goal is to reduce the need for all the phone calls, email price lists, face-to-face meetings and physical spot auctions, Budreski said.

— Erich Luening

Advertisement

- Newfoundland’s Northern Harvest expands with government funds

- First Nations projects get boost from national funding